The Right Vehicle for the Trip

Choosing the Right Vehicle for the Trip?

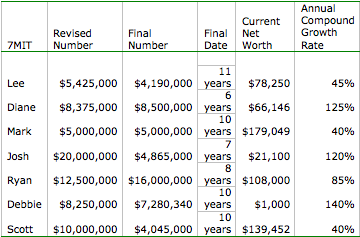

Scott seems to have his path pretty much mapped out; of course, combining business interests with investing is no ‘walk in the park’, as we’ll see later … but, I think Scott’s got a good chance of getting there: what do you think?

________________________

So you’ve figured out your number, that is, THE NUMBER that will enable you to live the life you’ve always dreamed of living, starting in the time frame that you would like to begin. Now what? How are you going to get there? Or in another way of looking at it, how will you choose the right vehicle for the trip to get you there?

For myself, after coming to the realization that I don’t actually need quite so high of a number in the next 10 years to fulfill my life’s purpose as I previously thought, I now have to pick the right vehicle, or investment vehicle that is, to be able to make this trip in due time. I pretty much think of this “trip” and this “vehicle” in much of the same way that I would think of any other form of traveling.

For example, living in Louisville, KY, if I needed to get to Indianapolis, Indiana in the next 3 hours, it would be very reasonable for me to make this trip by car. Seeing as though this is about a 2 1/2 hour driving trip, automobile transportation would be the best mode of travel, possibly getting me there a few minutes early to spare. But what if I needed to get to Los Angeles California in the next few hours? Well a car just ain’t cutting it! I’m going to need an airplane. You get the point.

This is kind of the way I see the next stage required for all of the 7 Millionaires in training (and any of you following along and applying these principles of wealth building for yourselves). Adrian has kindly pointed out a table for us all to follow, courtesy of Michael Masterson, that simply shows various percentages of annual required compound growth vs. the vehicle needed achieve that growth, eg. cd’s, index funds, stocks, etc…that is needed to get you to where you currently are to where you NEED to be:

According to Michael Masterson in his book Seven Years To Seven Figures:

Required Compound Investments

Growth Rate Required

4% CD’s

8% Index Funds

15% Stocks

30% Real-Estate together with Stocks

45% Real-Estate together with Stocks and Small Businesses

50%+ Start Your Own Business

And looking at where I am starting out in net worth on this journey vs. where I need to be:

It appears that I will need a 40% annual compound growth rate in order to land safely at my final destination over the 10 year period, from where I am departing from.

Now to back things up just a notch, my original vehicle of choice, even before getting to this stage of decision making on how I’m going to pull this off has been to use an expected combination of real estate together with stocks, all the while “fueled” if you will, by money seeded from my small business. As you can see, these tables match my personal goals completely across the board.

More specifically, I’ve estimated that I can invest an average dollar amount of between $3,500 to $5,500 per month beginning this January 2009 from my business, after personal living expenses are met at my family’s current chosen level of lifestyle. I can continue this amount of investing for 3 years due to expected income from business revenues, however, in 3 years, this amount will increase to approximately $8,000 per month to invest over the remaining 7 years of my 10 year journey. This is if I choose to do nothing else but continue to get dressed and head out to the office 5 days a week (and stay healthy and motivated to do so, of course, but more on this later, as I pursue additional businesses with which to gather more “seeds” from ). When I put these figures together and apply this “seed money” toward an expected annual compound growth rate of 26.3%, I’ll finish with $4,050,000.00 in exactly 10 years.

However, if I jump in a bit more powerful “jet” , let say, perhaps pushing the annual compound growth rate on up to around 40%, I can reach my destination between 7 and 8 years instead.

So I guess the next question to ponder would be “How willing are you to upgrade your mode of transportation?”

I hope some of us aren’t afraid of flying!

Good plan, Scott! Where does paying off your student loans fit in with your choices for the $3500-5000 you’re going to start investing in January 09? Will those be allowed to trickle along due to their low interest rate? How were you able to find the $3500-5000 (or make it available)? Was this thru applying Making Money 101 (paying off another debt) or through working a sideline or another investment that is part of your Making Money 201? Inquiring minds want to do it, too! 🙂