KLE 37: How To Handle Sudden Money

I’m not expecting any of our members to win the lottery … and, neither should you!

But, it is a sad fact that suddenly gaining a lot of money seems to make some people irrationally overconfident that they can repeat the process; for example, Camelot (the operators of the UK Lottery) found that “one in five winners (21%) are very confident of winning again.”

Stupid.

But, in case you are lucky enough to suddenly come across a lot of Found Money (e.g. by inheritance, winning the lottery, selling your business, insurance payout and so on), I want to give you some guidelines that will stop you from tossing it all out the window.

From now on, you should classify ‘windfalls’ with all other Found Money (KLE36): save at least 50% and spend up to 50%

If you’re lucky enough to receive such a windfall, you should spend enough to fully celebrate your good fortune (even more so if it was a result of hard work rather than luck).

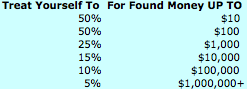

But, the amount you spend should be a reflection of how much Found Money you have, up to a maximum of 50% … for example:

– If you find $20 on the street, buy yourself a latte and a magazine and then put the other $10 in your end-of-month savings ‘cookie jar’

– If you sell your business for $2 Million don’t spend $1 million

– If you get a $200 a week pay increase:

… do spend $100 immediately (enjoy!)

… don’t spend $100 extra a week (unless you HAVE to)

Here’s a table that will help you decide how much to save and how much to spend, depending on how much Found Money you suddenly come across:

Note: You need to be a Premium Member to view this content:[Temporary Access Granted]

[/Temporary Access]

If you find yourself toward the high end of this table (e.g spending $1,000 or more), spend it on something – or, some things – that you will remember for a long time.

Ok, ok… you answered my previous comment in this one. This is basically the same pattern we follow.