KLE 39: Your One Time Expenses

By now, (if it’s been a month since you started your One Time Budget (KLE25), you should have a complete list of your expenses for the month.

But, you’re not quite done yet!

You may not have fully accounted for your bi-monthly, quarterly, bi-annual, and annual expenses e.g. rates, utilities, insurance, etc; if not, here’s how to deal with those expenses:

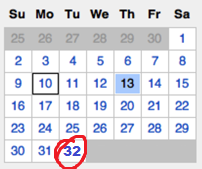

– First, you need to add a new ‘last day’ of the month (e.g. May 32nd … really!)

– Then, you can use that ‘day’ to write in 1/12 of any annual expenses that you may expect.

Think about any one-time expenses that aren’t set in concrete, but are reasonably likely this year, for you. Examples include: medical and dental expenses not covered by insurance; likely car maintenance/repair costs; and, so on. Think about past years: in this case, the past is a useful guide to the future, in the absence of any better estimates.

It’s that simple!

Task 1: This exercise will speak volumes about your current spending habits: were any of your expenses in your One Time Budget list for the month ‘one time’ expenses (i.e. paid only once – or, only a few times – a year?)

Task 2: What other ‘one time’ expenses do you expect to pay this year? What about a ‘buffer’ for ‘unexpected’ one time expenses, such as medical and dental expenses not covered by insurance?

Task 3: What is the monthly component of each of these costs?