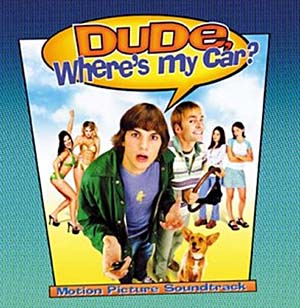

Dude, Where's my car fit in with my number?

Photo credit: maniadb.com

Dude, Where’s my car fit in with my number?

I was waiting for somebody to post this picture with this post, and I’m glad to say that Ryan didn’t disappoint! 🙂 Ryan’s post is a short-but-sweet one that raises some questions on buy v lease/finance and new v used … any thoughts?

By the way, Ryan’s current Net Worth can be found at: https://www.networthiq.com/people/PassiveSeeker …

____________________

I feel like we’ve done some good things with our auto purchases and some not so good things. We currently have a 2002 Mazda Tribute (Kelly Blue Book $8,700) and a 2006 Acura TSX (Kelly Blue Book $18,000). The Mazda we bought (I don’t believe in leasing) through payments over 60 months for a total of around $23,000. The Acura was $26,000 and we paid cash. We bought both of them new, which I think is the not so good thing, financially, but because we keep cars so long (at least 8 years) I’m not sure if that changes the situation. What I mean is, if we bought our cars when they were two years old, we certainly would have paid less, but there is some question as to whether or not we could keep them for the same amount of time.

I’m interested to hear what you guys think about new vs. used when keeping a car that long, and if there is ever a good time to lease.

Ryan I think you’ve done well by not leasing. I agree with you concerning not wanting to lease a vehicle and the only reason in the world that one of my 2 cars is a lease is because my employer opted to pay for it for me.

As far as the new car vs. used car debate, I believe that used is ALWAYS the best way to go. As you know, cars loose such a tremendous percentage of their value THE MOMENT they are driven off the lot. Some figures show this to be anywhere from 10% to 20% depending on brand and model and then loose quite a bit more within the first year and second year.

So basically you get a huge, sometimes 30% discount on a car that is exactly the same car and exactly the same shape as the showroom car(as long as you’ve done your research, been selective and choosy with your purchase with a car that’s been babied and taken excellent care of, and waved cash in the face of the person selling to get an even greater bargain. This works even better in a recession!).

If your buying quality cars, I don’t think you have too much to worry about concerning the durability of the car, even though you bought it used. In many cases, a slightly used, high-end brand car has just barely been ‘broken in’ by the first owner and it’s in prime condition for you and you still get the new car smell!

Buy slightly used, I think you’ll always come out better in the end financially if you run the numbers and you’ll get the exact same thing and no one (including yourself after driving it for 3 months) will ever know the difference!