I'm the liability ….

Are you an optimist or a pessimist (I’m already on record on this subject)? It might depend upon how well your assets outweigh your liabilities …

Are you an optimist or a pessimist (I’m already on record on this subject)? It might depend upon how well your assets outweigh your liabilities …

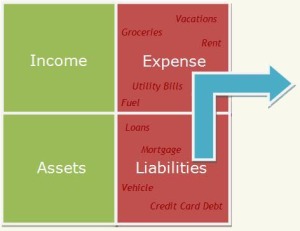

… this diagram shows quite nicely how the cash flows – out! – for each liability …. does that mean that a liability = bad? Not necessarily, it depends on how you use it to (eventually) drive (a lot more) cash back in!

It was enlightening to see the similarities – and differences – between the strategies for each of the 7 Millionaires … In Training! for each of their key ‘assets’: houses; cars; 401k’s.

Now, rather than ‘pulling teeth’ and looking at each of the separate areas of liability for each of the 7MITs – besides their bosses, coworkers, spouses and dependents 😉 – I asked each to just summarize what they owe, who they owe it to, what (if anything) they intend to do about it, and how (and by when). Perhaps, you should do the same?

I know we’ve already covered some of this (under cars and houses), but here we are really looking at the whole subject of liability/debt in one place.

I’m looking forward to see what they – and, you – come up with 🙂