The Bottom Line

The Bottom Line

Josh puts it right: “we are coming to the end of our net worth exploration and have generated a fairly specific map of where we have been financially and will soon be plotting course for the terrain ahead” … well summarized, Josh! 🙂

What’s Josh doing right/wrong? What can you recommend?

__________________

It seems we are coming to the end of our net worth exploration and have generated a fairly specific map of where we have been financially and will soon be plotting course for the terrain ahead. My networthiq graph shows the progress made since February 2008. Since then, I’ve put into practice what I learned on this blog and others. There isn’t much I would have done differently, I just wish I would have done everything a lot sooner. Saving, investing and actively learning about investments are some key actions I would have preferred to start in Pre-K rather then my last semester in college.

It seems we are coming to the end of our net worth exploration and have generated a fairly specific map of where we have been financially and will soon be plotting course for the terrain ahead. My networthiq graph shows the progress made since February 2008. Since then, I’ve put into practice what I learned on this blog and others. There isn’t much I would have done differently, I just wish I would have done everything a lot sooner. Saving, investing and actively learning about investments are some key actions I would have preferred to start in Pre-K rather then my last semester in college.

I still need to work on basic money management. Better budgeting for items I need to buy in order to maximize the amount I’m able to save and invest. This also includes money management for my internet business. This topic is approaching in the curriculum I’m studying in order to become a member of the CFA which has taken up ALL of my available time to do anything other then study, so learning more on that subject should solve two problems at once.

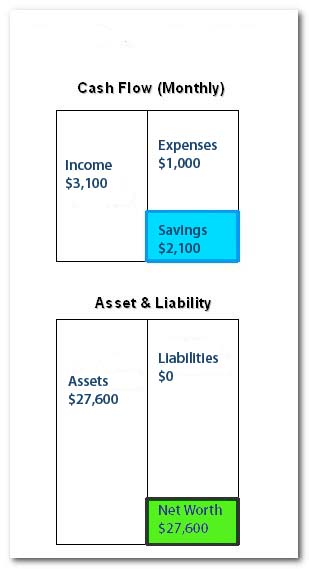

Before moving ahead in this experiment, lets record our current position.

Current yearly net earning from full time job: $31,300

Expenses include:

- Cell phone: $720 per year ($60 per month)

- Car insurance: $1500 per year ($125 per month)

- Gasoline: $ 1440 per year ($30 per week at worst)

- Food + other: $3600 per year ($300 per month)

- Cleaning Expenses: $480 per year ($40 per month, this is my share of a house cleaning service)

- Charity: $4800 per year ($400 per month, this is 10% of my gross income)

Total Expenses = $12,540

Income – Expenses = 31,300 – 12,540 = $18,760 per year (this does not include my 401(k) savings plan, which is automatically subtracted from my bi-weekly check and acts more as a retirement safety net.)

My Net Worth as of March, 2009

- Cash: $1,000 (I like to keep this around, just in case there’s a good poker game…just kidding)

- Stocks: $5,000 (this was down to about $3,000 in February, but has now recovered to about $5,000)

- Retirement: $12,000 approximately in a SDRA.

- Cars: $8,600 (just replaced the Audi with a 2002, 330xi. The Audi was totaled in a car accident, had to put in about $1500 out of pocket after insurance gave me what they thought the car was worth + cash from selling the crashed Audi + help from family.)

- Personal Property: $1,000 (TV, computer….stuff)

Liabilities = $0

Assets – Liabilities = $27,600

Recording this information is in itself exciting and motivating. I look forward to reading the suggestions, comments, and questions of those participating, following along or just stopping by.

Wow Josh, how in the world did you get an 02′ 330xi for 8,600.00?? The e46 330xi has been our plan for quite some time as a replacement for my company leased BMW when the lease is up in a little over a year. But we haven’t been able to find anything near as low as that, even in cars with 120k miles or more or with a salvaged title.