7 Millionaire In-Training! Review

7 Millionaire In-Training! Review

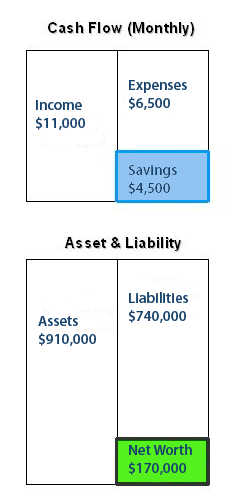

The diagram is mine, but the healthy financial ‘picture’ is all Scott’s … the poster child of the high-income earner / high-saver. Let’s hope that he also knows how to also have fun, but I guess a hobby farm with horses has got to provide a fair chunk of happiness?! Scott also has a ‘built in’ Income and Net Worth kicker when the contract surrounding the other half of the practice that he is in ‘kicks in’ …

What do you think Scott needs to do from here?

__________________

This next post provides a bit of a summary of where we are financially at the moment. You’ve gotten bits and pieces of where we currently are along the way, via several different posts and you’ve hopefully gotten a good picture of where we all want to be. Hopefully you’ve gotten a good idea of the various plans of action that each of us 7MIT need to take if we want to achieve our required annual compound growth rate, and hence our Number by our Date.

This next post provides a bit of a summary of where we are financially at the moment. You’ve gotten bits and pieces of where we currently are along the way, via several different posts and you’ve hopefully gotten a good picture of where we all want to be. Hopefully you’ve gotten a good idea of the various plans of action that each of us 7MIT need to take if we want to achieve our required annual compound growth rate, and hence our Number by our Date.

I know i’ve learned a lot myself so far since being a part of this site and this grand experiment. Among the lessons i’ve learned is that wealth creation can be broken down into 3 distinct categories; Money Making 101, 201 and 301. I’ve learned the 20% rule regarding equity in your home, the 25% rule regarding your monthly home payment and the 5% rule regarding other “stuff” so that you may have 75% of your net worth invested at all times while you are building your wealth along Money Making 201. I’ve also learned that the right kind of debt can be a good thing, as long as you have a low, fixed interest rate. This ‘good debt’ can allow you to develop your wealth faster by increasing your annual compound growth rate. This as well as the financial rules regarding your home will allow you to continue to expand your portfolio exponentially and reach your number the fastest. I’ve also learned that it is first important to do the utmost soul searching and discover your life’s purpose before you do any of this. Discovering your life’s purpose is the “Why?” associated to getting rich. Then you must calculate the “How Much?”, meaning just how much money do you NEED in order for you to live out your life’s purpose and then “When?” do you need it by. Once you figure out these things, you get a clearer picture of your life, a better focus and both excitement and fear under your wheels to get you there on time! I’ve learned about the debt avalanche and other Money Making 101 techniques.

Speaking of fear, there’s nothing like learning about how inflation can nip at your heels and chew away at your wealth. Not only are good money preservation skills important to learn to use in Money Making 301, but you must fully understand the power of inflation and what it means to your number, or in other words, just how much bigger your number must be to account for this inflation that will inevitably occur between now and your “Date”! These are extremely important mathematical factors that must be considered when designing your plan to launch.

Hmm, what else have I learned….Oh, I’ve confirmed my earlier suspicion that traditional retirement plans such as 401K’s, Roth IRA’s and the like are not only not the ‘only’ way to retirement and reducing taxs burdens, but they are not necessarily the best! That’s right. Robert Kiyosaki didn’t just explain this in his books to use up pages, he meant it. The wealthy didn’t get wealthy by saving money in tax-advantaged retirement accounts and the wealthy pay less taxes than everyone else.

Not only that, but if you’ve learned anything about life and how to accomplish your goals, you’ve learned that the truth is this: You get what you focus on, especially when you’ve trained your brain to see no other way. Focus your energy on safe, ‘governmentally designed’ fall backs and you’ll stay focused on a cushy, comfy ‘job’ with good benefits and retirement plan to work on for the next 30-40 years. While you make the owner of that business wealthier. Do you think that owner logs on to his/her ‘retirement account’ and get all giddy about it. No, they think about how many buildings they own, how much the individual stocks they buy are growing, how much they are going to sell their business for and how many other businesses do they want to develop. Focus on your Number, your Date and the required means to get you there, like there’s no other way available to you in the world and you’ll get there! You get what you focus on. Just like Warren Buffet and other incredibly successful investors and entrepreneurs have done and are continuing to do. Don’t ‘diversify’ your focus, don’t ‘diversify’ your energy and don’t diversify how you invest. That is, if you want to be wealthy rather quickly. After all, these blogs have to do with making 7 million in 7 years, not 2 million in 40 years, right?

I know i’ve learned an incredible amount more too, but I believe those are some of the most important lessons. I can’t think of many specifics that I’m struggling with so far concerning my life’s purpose, or what to do at this very moment concerning my networth status or this phase of my journey. I’m pretty much in the flight of Money Making 201 with my destination and my time tables in place. I’m just focusing on clear, easy weather and a smooth flight! But I know the flight will get bumpy. That’s life, but just like anything else i’ve accomplished, i’ll navigate around and through all the storms to get there.

I believe an income statement is in order for this post, so I’ll give a run down of our current numbers. My wife is currently unemployed due to layoffs and has been that way for the better part of the past 9 months. I run a successful practice that I currently own 50% of, so naturally i’m only entitled to half of the profits that I am currently generating. As such, my income varies of course, but it appears that if I take my average over the past few months, i’m averaging somewhere between 170-180k before taxes. That’s usually between 14k and 15k per month of which 5k per month is my base pay and doesn’t change. The rest is a distribution income based on the monthly profits, hence why it changes. Tax is deducted from my monthly base, so I take home right at 3,800.00/month from that and I pay taxes off my monthly distribution quarterly. What we’ve been doing is just setting the quarterly estimations aside and paying them out quarterly. I deduct as much as possible from my personal vehicle, down to business lunches, continuing ed seminars, right down to the shoes I wear in the clinic and have to replace. This all reduces my tax liability, as well as any depreciations I deduct with my rental property business. Speaking of the rental property income, I’m only cash flowing 50 bucks per month on the rental at this very moment, but get a nice tax deduction from it on my income.

All in all, after tax, we are depositing around 11k per month on average into our checking, of which we are living on exactly half of. 5,500.00 per month for our basic living cost and ‘lifestyle’ if you will and $1000.00 per month goes to “home improvement” for the farm we bought last year that we are taking our time finishing renovations on. This provides us an average of about 4500.00 per month to invest. If you watch our networth profile carefully over this year, you’ll see our “cash” section going up by this much per month on average. You’ll then see this cash disappear some or lessen as we purchase assets such as real-estate, other businesses, invest in my current business to make it grow, spin off more cash itself, or increase in value, etc…Some months that monthly cash savings may go up by twice the amount due to me producing a really good month and some months, you may see it be a bit less during slower times.

Currently in the “Other” category on my networthiq profile, https://www.networthiq.com/people/abundantlife, this is where we’ll keep business assets or rather their current market re-sale values. This currently includes my personal shares of my practice and may in the near future include the value of any other businesses that I start or acquire. In a little over 2 1/2 years. The end of 2010 to be exact, I’ll become 100% owner of my practice, so you’ll see that current number probably double. My income should pretty much double as well which will help to further fuel my required annual compound growth rate.

I guess that’s pretty much it as far as my networthiq profile. Personal property includes my valuable guitars, guns, my wife’s jewelery, any antique furniture that we have that could be sold for something. Lawn tractor and basic farm upkeep equipment, horses, etc..

The ‘other real-estate’ category currently includes the value of our rental and will include the total values of course of any other real-estate properties that we acquire. “Other mortgage” is where we’ll keep the total of all investment real-estate mortgages owed.

The student loan is consolidated and fixed on a 30 year at 2.85%, the mortgage on our primary residence is fixed on a 30 year at 6.25%. Oh yeah, that reminds me, one of our plans is to refinance our rental. We were suckers for a crappy mortgage on that house when we first bought it nearly 3 1/2 years ago(it was our first home) and we want to refi to get a low fixed rate. Currently the mortgage on that property is an 80/20 with a 5 year interest only on the big one and a 20 year balloon on the small one. Man we were so dumb and gullable a few years ago compared to now. It currently averages around 8.5% as it is, with obviously very little payment going to principle, but if we get that property refinanced to a low fixed rate for 30 years, we’ll be cash flow positive by a couple hundred dollars per month as well as enjoy the tax deductions, so that is a goal of ours. Other than that, we don’t really have any questions about anything else that I can think of.

[…] and, since you are one of the 7 Millionaires … In Training! I will show you exactly how to do it … and, anybody who wants to be a fly on the wall (better yet, participate in the open […]