Just Numbers

Just Numbers

Mark discovers that living his “Life’s Purpose” too early can have a financial cost … do you see something a little ironic in this? 😛

What advice can you give Mark?

__________________

I’ve been tracking my numbers using Quicken for a while. I remember using it a lot more a few years ago when I have the 2001 edition. It is more manual but at least I know I need to work on it to keep it updated. Unfortunately, I upgraded to the 2007 version. The conversion didn’t go quite well and I lost some of the reports I used to keep track of my income and expenses. 2007 includes automatic updates which makes me use it lesser and I do lose track on my expenses as we discover below.

I’ve been tracking my numbers using Quicken for a while. I remember using it a lot more a few years ago when I have the 2001 edition. It is more manual but at least I know I need to work on it to keep it updated. Unfortunately, I upgraded to the 2007 version. The conversion didn’t go quite well and I lost some of the reports I used to keep track of my income and expenses. 2007 includes automatic updates which makes me use it lesser and I do lose track on my expenses as we discover below.

How do we compare the usage of Quicken and NetworthIQ?

Although I prefer to use Quicken, it is harder to add notes to it or get involved with other like minded people. I haven’t been leveraging NetworthIQ that much although there are good information among the Questions and Tips.

Over the last year, I have been struggling in terms of aligning my goals towards achieving my number. I seem to do quite well following Money Making 101 and some of its rules, but I haven’t quite make it to Money Making 201 with much success yet. I did experiment with stocks and options trading, some real estate investments and a half-hearted effort to do something online. My main enemy has been time where I am unable concentrate on any one of the investment activities and unable to cope when my current work requires extra effort (working nights and weekends).

Some of them are my own doing where I choose to travel to various destinations and enjoying life. I may have put too much emphasis on the “enjoy life” part of my life’s purpose. 🙂

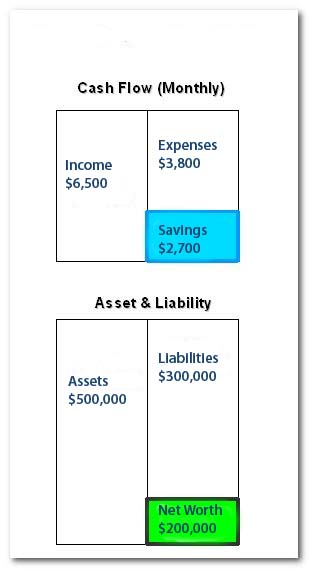

Let’s go through our current exercise where we focus on our “Income Statement” and “Net Worth Statement”. The reference will be the numbers from my NetworthIQ profile.

Income Statement

My current monthly net income after taxes is about $6,425

I haven’t tracked my expenses in detail for a while even though I’ve been using Quicken and I’m surprised to see some areas where I can easily cut down.

Current Monthly Expenses (average for the last 12 months):

- Housing – $980

- Gifts (gifts for family and friends, mostly family) – $925

- Auto – $267

- Entertainment (been to many concerts, musicals, activities and events) – $266

- Utilities – $256

- Dinner and Lunch outside – $228

- Vacation (low number since I’ve used airline miles for 2 international trips) – $224

- Charity – $191

- Misc (Electronics, Clothes, Insurance, Cash) – $406

The total is about $3,743.

This indicates a savings of $6,425 – $3,743 = $2682

The $2682 goes into the 401K ($891), ESPP ($1248), HSA ($162) and building cash reserves or fund investment activities ($381).

My income and expenses will definitely change in the near future since the above numbers does not include my new residence and potential rental income. These numbers are not available yet but the Net Worth Statement below did take my newly acquired primary residence into account.

Net Worth Statement

Using my NetworthIQ profile, you can see that my current assets are:

- Cash $21,016

- Stocks $22,387

- Retirement $78,781

- Home $209,900

- Other Real Estate $141,300

- Cars $8,500

- Business accounts (savings, checking, investments) $4,500

The total is $486,384.

However, the liabilities are:

- Home Mortgage(s) $183,420

- Other Mortgage(s) $108,966

Total liabilities: $292,386.

Current Net Worth: $486,384 – $292,386 = $193,998

Great job so far Mark. It looks to me like you are in Money Making 201 with no debt and a recently started rental property.