Income Statement

Take note of Ryan’s list of 5 things that he has learned from this ‘grand experiment’ so far … they are all important observations. Ryan may be surprised to learn that I am equally risk-averse and DO advocate a safety net …

As Ryan asks, what advice can you give to Ryan? I’m sure that he’d love to hear from ALL of our readers, not just the other MITs …

___________________

I’m sure there are a lot of ways to get out of debt. I’m so sure because I see ads everyday on T.V., hear them on the radio, and see books packing the shelves of Barnes & Noble all about how to do it. What you don’t see in any of those places is a reputable way to get from debt free to wealthy.

I’m sure there are a lot of ways to get out of debt. I’m so sure because I see ads everyday on T.V., hear them on the radio, and see books packing the shelves of Barnes & Noble all about how to do it. What you don’t see in any of those places is a reputable way to get from debt free to wealthy.

That’s why I’m part of this experiment and it’s in that area that I’m learning a lot from this blog and from those of you that are kind enough to continue the discussion in the comments section of each post.

Things of note that I’ve learned so far include:

1.) Consider the percentage of compound growth you need to reach your number – and, by when – for the investment decisions you make.

2.) As with #1, just because something (i.e.- 401k) has good tax advantages now, doesn’t make it a good investment. If it doesn’t pay out until well after you want to retire, what good is it? (Though I probably will continue my existing 401k, on the back burner, and may or may not make SMALL contributions just in case!)

3.) I can’t get to my number with stocks, bonds, and real estate alone.

4.) If you “strike it rich” without a pre-established goal or “number”, you won’t know you’re there!

5.) The 25%, 20%, and 5% rules.

I’ve also learned that risk aversion may be my biggest struggle in my personal journey. I have confidence in myself that I will succeed and rarely think about failure. That said, I have a wife and two kids and need them to be and feel secure, so I will probably have more of a safety net than Adrian might suggest.

The other big question I currently have is which investment vehicle to go with next while I develop my intellectual property. I want to buy either a rental property or commercial office/retail space and would love to hear from any of you that have experience with either.

Now you know what I’ve learned, and what I want to learn near term. Here is a look at my current financial situation at networthiq

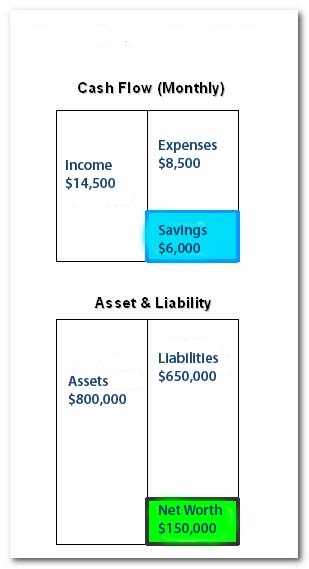

And Here are some clips from my monthly financial spreadsheet:

| Monthly Income Statement | ||||||

| Income | ||||||

| A.Earned Income | ||||||

| Job / Self Employment Salary | $28,140.00 | |||||

| B.Passive Income | ||||||

| Net Real Estate Income | $- | |||||

| Net Business Income | $40.00 | |||||

| B.Passive Income Total | $40.00 | |||||

| C.Portfolio Income | ||||||

| Interest | $33.00 | |||||

| Dividends | $12.00 | |||||

| Royalties | ||||||

| C.Portfolio Income Total | $45.00 | |||||

| D.Total Income | $28,225.00 | |||||

| Total Passive Income | $85.00 | |||||

| Expenses | ||||||

| E.Expenses | ||||||

| Credit Card Payments | $- | |||||

| Personal Expense Ryan | $200.00 | |||||

| Wife (mostly groceries) | $900.00 | |||||

| Gross Mortgage | $3,301.00 | |||||

| Utilities | $225.00 | |||||

| Entertainment | $687.95 | |||||

| Life Insurance | $38.50 | |||||

| Other Payments | ||||||

| Auto Insurance | $207.75 | |||||

| Business Expenses | $2,996.00 | |||||

| E.Total Expenses | $8,556.20 | |||||

| Gross Earnings | ||||||

| My “job” | $19,700.00 | |||||

| My company | $8,000.00 | |||||

| Wife’s job | $400.00 | |||||

| MLM | $40.00 | |||||

| Total | $28,140.00 | |||||

| IRA | ||||||

| IRA | $7,000.00 | |||||

| Wife’s IRA | $34,000.00 | |||||

| SEPP | $25,000.00 | |||||

| Total | $66,000.00 | |||||

| Stocks | ||||||

| GE | $1,408.00 | |||||

| Target | $1,344.00 | |||||

| JNJ | $49.00 | |||||

| Other | $1,300.00 | |||||

| Total | $4,101.00 | |||||

| Entertainment/Other | ||||||

| Charity | $100.00 | |||||

| xm | $12.95 | |||||

| other | $100.00 | |||||

| gifts | $125.00 | |||||

| medical | $150.00 | |||||

| eating out | $200.00 | |||||

| Total | $687.95 | |||||

| Utilities | ||||||

| Gas | $28.00 | |||||

| Cable | $102.00 | |||||

| Phone | $95.00 | |||||

| Electric | $85.00 | |||||

| Water | $50.00 | |||||

| Trash | $15.00 | |||||

| Total | $225.00 | |||||

| Business Expenses | ||||||

| Rent | $1,200.00 | |||||

| Healthcare | $393.00 | |||||

| Child Care | $250.00 | |||||

| Auto Fuel | $200.00 | |||||

| Sepp | $833.00 | |||||

| MLM | $120.00 | |||||

| Total | $2,996.00 | |||||

| Mortgage | ||||||

| Home Mortgage | $2,100.00 | |||||

| Homeowner’s Insurance | $65.00 | |||||

| Earthquake Insurance | $20.00 | |||||

| Association Fees | $216.00 | |||||

| Property Taxes | $900.00 | |||||

| Gross Mortgage | $3,301.00 | |||||

| % of gross income | 11.70% | |||||

| Balance Sheet | ||||||

| Assets | Liabilities | |||||

| Savings | $45,000.00 | |||||

| Stocks | $4,101.00 | Credit Cards | $- | |||

| $- | Car Loans | $- | ||||

| IRAs | $66,000.00 | Student Loans | $- | |||

| $- | Home Mortgage | $665,000.00 | ||||

| Real Esate (Less Mortgage) | $- | Personal Loans | $- | |||

| Business Value (Net) | Other Debt | $- | ||||

| F.Assets Subtotal | $115,101.00 | J.Total Liabilities | $665,000.00 | |||

| G.Doodads | ||||||

| Home | $630,000.00 | |||||

| Cars | $30,000.00 | |||||

| Other | $12,000.00 | |||||

| G.Doodads Total | $672,000.00 | |||||

| H.Total Assets | $787,101.00 | K.Net Worth | $122,101.00 | |||

| (Bankers Version) | (Bankers Version) | |||||

| I.Total Assets | $115,101.00 | L.Net-Worth | $(549,899.00) | |||

| (Rich Dad Version) | (Rich Dad) | |||||

| Gross Income Less Expenses | $19,668.80 | |||||

| Net Income Less Taxes | $18,062.80 | Amount Available to Invest this month | ||||

Note:

I usually use about $14,500 as an average after tax monthly income for planning purposes.

Intend to use surplus funds for commercial or residential RE and potentially develop IP

So what stands out to you? Any advice?

Ryan, you are doing awesome man. It looks like you’ve stepped your income up quite a bit recently, great job! You’re doing everything right as far as I can see and you’re in Money Making 201, the question to you will be “What to do with this cash savings that’s piling up?”

The right answer to that question will get you to your number faster, I think.