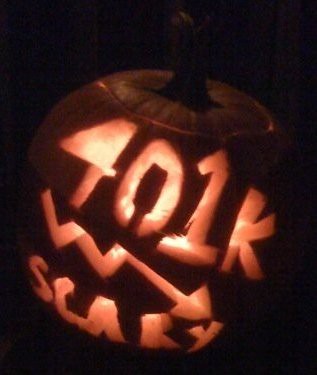

201K

201K

Photo credit: krodinjw

Mark’s experience (50% losses in his 401k; 75% losses in his Roth IRA) prove that it’s not the 401k or the Roth IRA that is the problem, it’s what you put IN them that counts … in Mark’s case, he’s prepared to wait 20 to 30 years to cash them out … presumably, these are ‘backstops’ for him in case his plans to reach his Number don’t pan out?

As Mark asks: what can we learn from all this?

_________________________

As an employee, the 401K program is definitely one of the easiest “savings” vehicle. It is automatic, you don’t see the money when you get the paycheck and the employer matches too. However, it is tightly tied to the stock market; it goes up and down over the years; depending on your investment choices.

Currently, I’ve 2 retirement accounts, 401K and Roth IRA. I’ve been contributing to the 401K account for the last 8 years at 10% of my salary. It was bad during the first couple of years where we experience the dot com bust, good to very good the next 5 years and an almost disaster the past 1 year. It is amazing that in 1 year, you go loose so much on paper.

As of writing, the 401K is valued at $64, 600. It is down probably around 50%, just like the Dow Jones Industrial. It has a good mix of large cap, mid cap, small cap, and international mutual funds. Am I concerned about the return? Yes definitely. Am I underwater? Yes, on paper. But am I breaking sweat about it? Not really. I don’t need the money now and it still got 20-30 years to recover before I can start withdrawing. Will it recover or produce decent returns by then? Probably. I’ll just continue what I’m doing right now since it is automatic and it is getting an employer’s match at 6% up to $750 per quarter. That is a maximum of $3,000 that I get every year.

The Roth IRA was a pet project of mine. I enrolled in an advisory service to auto trade calendar options. It was doing well for 2-3 years until the sharp reversal the past year. It is valued only at $4,200 right now, mostly in cash. There are huge losing positions in there. The losses in this account is about 75%. Lesson learned for sure and I did learn a few things; a rather expensive education for me 🙂

What can we learn from all this?

Hey Mark, I can definitly relate to hard lessons in the stock market, the good thing is once learned, you can use that experience to either make it back, or subvert a loss in the future.