Going Vertical

Going Vertical

Jeff’s got a great analogy about Space Shuttle take-offs v Navy Jet Fighters – when was the last time that you actually got to fly one of those things, Jeff? – that tells you a lot about how he thinks!

What advice can you give Jeff from your perspective, be it stratospheric, strictly earthbound, or anywhere in between?

_____________________

I’m sure Adrian advocates an aggressive vertical takeoff profile, given the picture he chose to use of the space shuttle taking flight.

My typical launch profile is a bit different than that of the Space Shuttle. I’m used to starting from a standstill, checking the instruments, stroking the afterburners, taking level flight to build speed, and then pulling up to start a climb. I’ve been launching this way for about 17 years now. Not just professionally as a Naval Aviator, but also financially.

However, I think I’ve may have stayed in ground effect for a bit too long financially and its now time to pull back on the stick, load up the “Gs” and take things vertical.

But there’s more to going vertical than just honking on a big ‘ol pull on the control stick. Pull too little or too late and you might not clear the trees at the end of the runway. Pull too much, too quickly or too soon and you could decelerate rapidly causing you to peak out lower than you intended. There’s a science to looking cool.

The struggle I am having in our experiment is one of changing old habits. I’m finding that old investing habits can be hard to break, especially those that you believe have been good ones.

I have been a typical retirement account poster child. I use ’em and I max ’em out. And I haven’t done too bad along the way. I’m on track to be comfortable later in life, not having to work until I die, nor rely upon the charity of my children.

But being comfortable in 27 years is not why I’m here. I want to find a time machine to shave 17 years off that clock.

Let’s take a closer look at where things sit right now and determine if I have enough airspeed on this baby to take her vertical.

INCOME STATEMENT

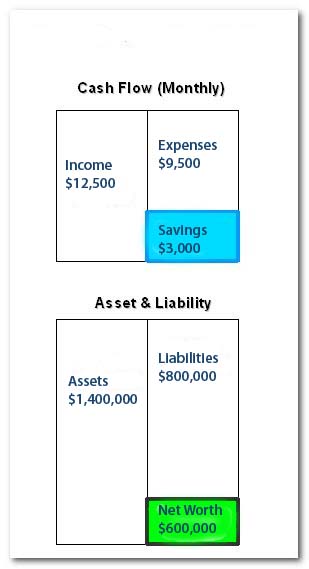

Adrian made a nice graphic at the top of the page capturing my monthly income statement. Before I add a little more detail, I have a small confession to make first.

Those numbers reflect what life will look like in May 2009. My pay is still fluctuating from my recent move and won’t settle out completely until I officially “check in” to my new command on May first.

Monthly after tax income: $12,501 (made up of my paycheck and rental income)

Monthly expenses: $9,512 (made up of living expenses and two mortgages)

Monthly savings: $2,989

My surplus is normally divvied up between a 401K, two Roth IRA’s, two 529 college accounts, and cash savings. However, right now everything is being funneled into money market savings to replenish my cash reserves and cushion the unforeseen expenses that come with a move.

NET WORTH

Reviewing my net worth profile yields the following:

Total assets: $1,355,253 (two houses, two cars, one boat, cash savings, and several retirement accounts)

Total liabilities: $753,755 (two mortgages, one short term bridge loan tied to my home)

Net worth: $601,498 (this is a new all time high for me)

WHAT’S NEXT

Reviewing all these numbers helps me understand some of my hesitation and reluctance to step away from my past investing practices. Things don’t feel broke.

Adding to this hesitation are concerns for those who rely upon me. I have a wife and two kids that are depending upon the course I chart.

What if I make a misstep in this experiment?

What if I lose it all trying something new?

Failure is not an option.

If I’m going to pull back on the stick the right amount, I have some more work to do in order to determine how much “pull” is enough.

But I’m committed to this and have been laying the ground work necessary to begin shifting my investment portfolio from mutual funds to a concentrated selection of individual stocks so that I can take this baby vertical.

Keep your eyes on the sky.

I’ll be the one with my hair on fire.

You know, I didn’t even think to consider my rental property rent received on my income side, then add that mortgage to my expense side. Right now i’m breaking even on the payments vs the mortgage and just getting the tax breaks.

You’ve definitely done well over your career, but I certainly know the feeling of needing to really “take off”. I too have had my nose to the grindstone since I left for the Army at 18, virtually with no breaks in focus, concentration and a growth mind-set, but even with all the years of work and dedication, I still see myself retiring ‘comfortably’ in my 60’s instead of being wealthy in my 40’s if I don’t take the action that i’m now taking.

It’s time for us to get busy!